First Home Buyer Guide & FAQs

Family enjoying property bought at auction

Family enjoying property bought at auction

From saving for a deposit, to navigating the First Home Grant, and comparing mortgages; our simple guide is here to help you get the keys to your first place.

Buying your first home can be thrilling. With it comes the freedom to paint and renovate as you’d like, a chance to escape that overbearing landlord you’ve been dealing with for years, and the space to start a family. But there are a lot of things you should know as you set out on the path to becoming a first-home buyer. The property market can be a confusing – and competitive place. How much do you need to save for a first-home loan deposit? Can you use KiwiSaver contributions? What is the First Home Grant scheme?

We’ve got you covered with this real life guide to buying your first home, which could help take some of the stress out of one of the most exciting experiences of your life.

First home buyers guide: What to know about buying your first home

The first, and for many, hardest, step in buying a property is saving a deposit. How much you need to save and how long that will take depends on several factors, including how much your home might cost, your income and your lifestyle.

Saving up tens, if not hundreds, of thousands of dollars can seem intimidating. That’s why one of the first things you could do is set a deposit target. To get an idea of how much you’ll need, research areas in which you want to buy. It could be a good idea to look at recent sale prices of homes that are similar to ones you have your eye on, and check out average year-on-year percentage price increases. This should give you a good idea of how much your first home could cost.

You might’ve heard that the recommended deposit amount to set your saving sights on is 20% of your new home’s purchase price. While this might seem like a mammoth task, we've got a few considerations to help you break it down:

Hints on how to start saving for your home loan deposit

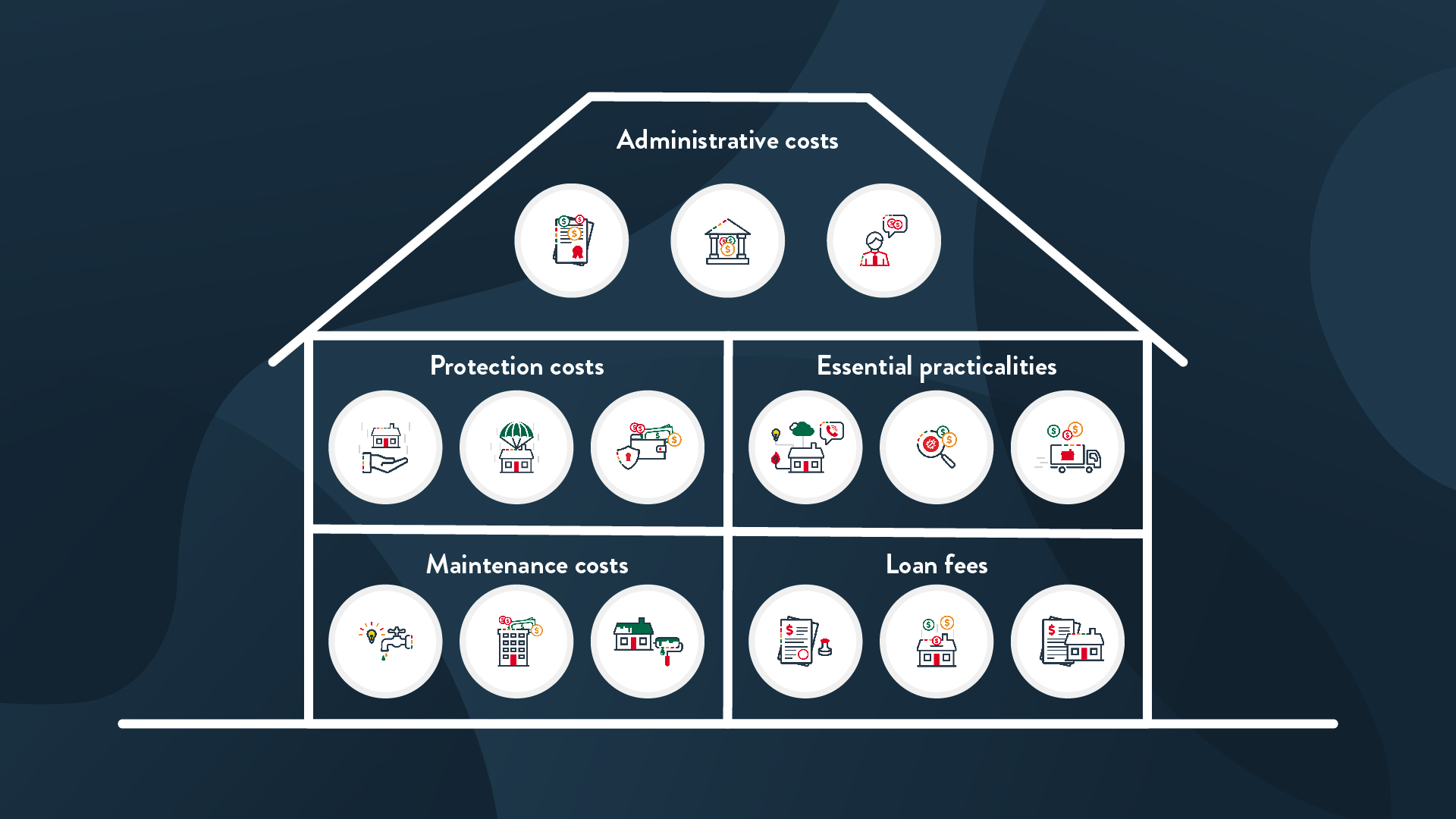

A heads up on other first-home buyer’s fees

Your deposit isn’t the only thing you have to take into account as a first-home buyer. Regardless of how much you need to save for your deposit, you also need to factor in additional costs to finalise the purchase of your home, including the following:

-

Conveyancing fees

-

These cover the legal costs involved with purchasing a property and can be anywhere between $1,000 - $2,000 depending on your chosen provider.

-

Application fees

-

Also called establishment fees, these are costs that some lenders charge for the application and settlement home loan process.

-

Council and water rates

-

You’ll need to ensure you’ve got enough to cover these.

-

Strata fees

-

If you’re buying an apartment or townhouse, then there will be a strata fee that you’ll need to pay, usually quarterly.

Other considerations for your mortgage application

Do a deep dive into your credit history

Your credit score and your credit rating plays a big role in determining success with your loan application in the eyes of a lender. While Pepper looks at much more than just this information, it is a piece of the puzzle that helps lenders determine who to offer credit to.

A credit score is a number put together by a credit reporting body or lender that summarises the information in your credit report and provides an indication of how likely you are to pay back the money you owe to a credit provider. It takes into account things like loan repayment history (including credit cards), the number and type of credit accounts you hold and the frequency that you’ve applied for credit. Credit reporting bodies or lenders use a complex algorithm to calculate a credit score, generally from 0 to 1000. While scoring will vary between credit reporting bodies and credit providers, the higher the score the better and anything above 700 is generally good.

Review your current debts

Having several loans or multiple lines of credit such as credit cards may impact your credit score and credit rating negatively. So, before you apply for your home loan, you may want to see if you can close credit cards you no longer use and lower the limits for others.

Also consolidating or paying off as much outstanding debt as possible could help. If you have an outstanding university HELP balance, lenders will take this loan into account when assessing your loan application.

Genuine vs. non-genuine savings

Lenders will assess your savings, specifically if they are genuine or non-genuine. Genuine savings consist of money saved up over time – generally any savings you’ve held for at least three and sometimes up to six months. Non-genuine savings include money you’ve received, such as an inheritance or gift from a family member, a work bonus or capital gains from selling an asset. These may be considered genuine savings by a lender after being in your account for three months or longer.

While not true of all lenders, Pepper Money accepts gifted, non-genuine savings for most of our loan options. Learn more in our guide: understanding the difference between genuine and non-genuine savings.

Employment

If possible, it’s a good idea to avoid changing careers or jobs when getting ready to apply for a home loan. Lenders generally like applicants who can show stability across not only credit history, but also employment, income levels and career paths.

Starting a new business might mean inconsistent cash flow early on, which can raise red flags with lenders. And even if you’re not self-employed, lenders will often check that you’ve passed probation at a new job or see if you’ve had a sustained period of experience in the same industry when assessing your application.

What if you’re self-employed?

If you’re a sole trader or otherwise don’t have regular access to some of these records, there are self-employed home loans you can apply for using alternative documentation.

Other bits and pieces

You are protected by responsible lending laws. Because of these protections, the recommendations given to you about home loans are not regulated financial advice. This means that duties and requirements imposed on people who give financial advice do not apply to these recommendations. This includes a duty to comply with a code of conduct and a requirement to be licensed.

All loan applications are subject to the lender completing responsible lending checks and considering the borrower’s individual circumstances. Terms, conditions, fees and charges apply. Information provided is factual information only and is not intended to imply any recommendation about any financial product(s) or constitute tax advice. If you require financial or tax advice you should consult a licensed financial or tax adviser.

© Pepper New Zealand Limited NZBN 9429031065153 | NZ Company Number 3416551